COVID-19’s Impact on Ecommerce and Online Shopping

By the second quarter of 2020, our lives as we knew them had changed significantly. But how have things changed 18+ months on?

The lockdowns that were so rampant last year have lifted, and restaurants, movie theaters and gyms have largely reopened. But many of those in-person businesses are facing staffing shortages while children are still out of school (whether by parent preference or school mandate).

Meanwhile, as you’ve probably seen in hundreds of posts on LinkedIn, many office workers are facing the challenges of going back to work while the virus (to varying degrees across the country and the world) is still a factor — or choosing to leave their jobs for a more remote-friendly company.

Despite those who call this the “post-COVID” era, the situation is still rapidly changing. But retail and ecommerce businesses have begun to see new behavioral shifts in shopping habits, as well as which changes over the past year show signs of sticking.

COVID Ecommerce Trends

The digital economy boomed during the COVID-19 crisis. As people embraced social distancing, they turned to online shopping more than ever before. 67% of consumers report they shop differently now due to COVID-19.

Retailers stepped up to the challenge, not just by supporting more online sales, but by embracing emerging technologies that created connections with shoppers or made their customer experience more convenient.

1. New trending product categories.

Grocery ecommerce soared in the second week of March 2020. “In a matter of months, the grocery ecommerce landscape in North America accelerated by three to five years,” wrote analysts at McKinsey, who also provided the below data:

- 20-30% of business moved online during pandemic’s peak

- Online grocery penetration settled at 9-12% at the end of 2020

With the broad expansion of product categories shoppers are likely to order from online retailers, Walmart grew its digital grocery business in 2021, and eMarketer says they’ll outsell Amazon in that category this year.

Home goods and fitness products saw sales growth, too. Recreational goods spending increased by 18% due to increased spending on home gym equipment and the furnishings and household equipment sector grew by 5.7%.

Will these trends last into the transition to the “new normal”?

While grocery ecommerce growth penetration is expected to continue, to reach 14-18% in the next three to five years, some analysts think home goods and fitness spending will cool.

2. Lower loyalty.

For a wide variety of reasons, consumer loyalty to their typical brands has fallen. eMarketer reports that in mid-2021 more than 80% of consumers reported buying a different brand than usual — and that’s a trend that started early on in the pandemic. Today’s reasons are typically around lower prices (65%) and out-of-stock products (51%).

3. Contactless payment.

It’s not practical to expect that online transactions could replace every single in-person purchase. That’s why big strides were made over the course of the pandemic in various contactless payment options.

eMarketer reports that the number of people globally who used proximity mobile payments in 2020 grew 22.2% year over year.

4. Coronavirus-friendly fulfillment.

While some shoppers turned to digital commerce, others made use of new or expanded pick-up or delivery options from their local, physical stores.

Thanks in part to grocery stores enabling online purchases, third-party delivery providers like Instacart partnered with them to accelerate delivery services, and food delivery companies like DoorDash and Uber Eats began including grocery delivery as well.

And curbside pickup, both from restaurants and brick-and mortar-stores, particularly gained momentum as a contact-free way to pick up their purchases on their own time.

5. Social media shopping.

Several social media platforms took advantage of higher online retail demand by adding more commerce features, enabling shoppers of participating online retailers to browse and purchase products without ever leaving the platform. These platforms are typically closely integrated with ecommerce platforms so that ecommerce operators can easily promote their products in multiple places.

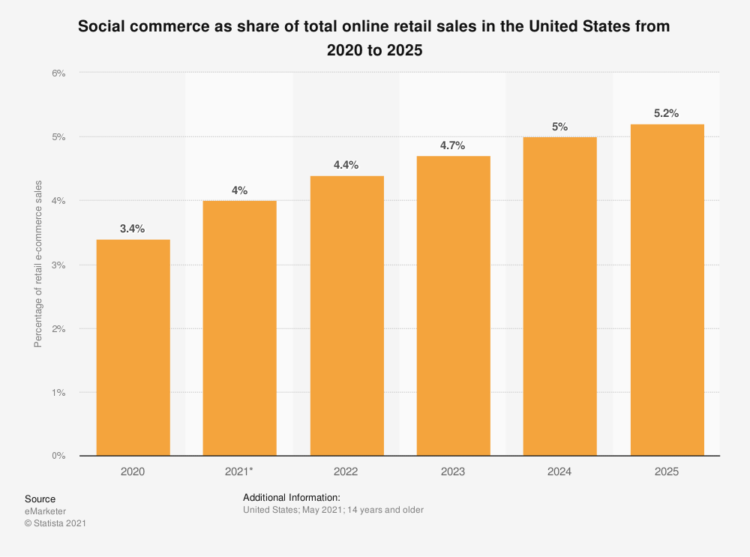

In 2020, social commerce made up 3.4% of total ecommerce sales, and that percentage is expected to continue rising.

However, though social platforms are offering more opportunity than ever to contribute to total retail sales, it’s not just through on-platform shopping.

The majority of Millennials and Gen Z think social media platforms are better places to learn about new products than online search.

Lingering Pandemic Disruptions to Consumer Behavior and Supply Chains

The fluctuation of the COVID-19 pandemic and the ways it influences our shopping habits will likely continue into the foreseeable future.

Spikes in virus cases in certain geographies may temporarily accelerate online orders and the need for home delivery. In other places, cases may cool, increasing in-person retail sales.

Omnichannel and online shopping will continue to pervade the retail world, particularly aligned to concerned shoppers with a reduced-contact mindset.

But the disruptions aren’t only on the consumer side. Supply has its own issues, thanks to changing patterns changing the expectations for a supply chain not ready to adapt.

According to McKinsey, fluctuating demand in the U.S. is driving shipping demand, causing congestion in ports — but COVID-19 has led to port lockdowns, which is further resulting in shipping capacity reduction.

“The disruption of trade between the APAC region and the Americas has never been so strained,” said Web Smith of 2pml. “The simple function of shopping for goods and services is no longer efficient in many places. Now, multiply this inefficiency by 1,000 and you have the global shipping crisis in need of a long-term solution.”

Post-COVID Commerce is Omnichannel

The major shift to ecommerce in 2020 is clear — but will it continue?

eMarketer predicts retail ecommerce sales will continue to grow by double digits through 2023 worldwide. That said, foot traffic is starting to come back as well.

It’s clear that moving forward, choosing between online sales and brick-and-mortar stores won’t be the answer — instead, “offering a compelling omnichannel experience…is a requirement for survival,” says McKinsey analysts.

Those at NieslenIQ agree: “Moving forward, retailers should expect regular disruption. Be prepared for the bullwhip effect (the increasing swings in inventory due to shifts in consumer demand). Operate with the expectation that employment disruptions will continue given the unpredictable nature of today’s job market.”